Gusto Review: What is Gusto?

Gusto began as ZenPayroll in 2012. Gusto’s three founders resided in Palo Alto together. One even did not sleep in the closet, as they wanted to share the space, but all the bedrooms were already occupied.

The initial goal was to build a backend system that would allow them to pay for their efforts. Today, more than 100,000 businesses across the United States use Gusto to manage payroll and administer benefits. Gusto is headquartered located in San Francisco, New York City, and Denver.

Over 100,000 businesses in the U.S. are using Gusto payroll software to manage benefits and payroll.

Gusto has offices in San Francisco and New York City.

Visit Gusto

Gusto Pros and Cons

Pros

A simple, clean, and easy-to-use layout for employees and management

Additional services and features are available, such as early pay, vacation, and owners' draw options.

Fast direct deposit options, even for small businesses such as mine that aren't making large profits. This was amazing.

Very friendly and prompt customer support

Cons

The fees are slightly higher at the high end.

Paystubs could be a bit more formal than the minimalist look they currently sport.

Small businesses can be difficult to verify because their actual business name is not shown on bank statements.

Comparison Table: Gusto vs Paychex vs OnPay vs ADP

|  |  | |

Gusto | Paychex | OnPay | ADP |

| Direct Deposit? Yes | Direct Deposit? Yes | Direct Deposit? Yes | Direct Deposit? Yes |

| Trial Period? Yes | Trial Period? No | Trial Period? 30 days | Trial Period? 3 months |

| $39, plus $6 per employee | $59, plus $4 per employee | $36, plus $4 per employee | Custom |

Gusto Review: Plans and Prices

Gusto Payroll Cost

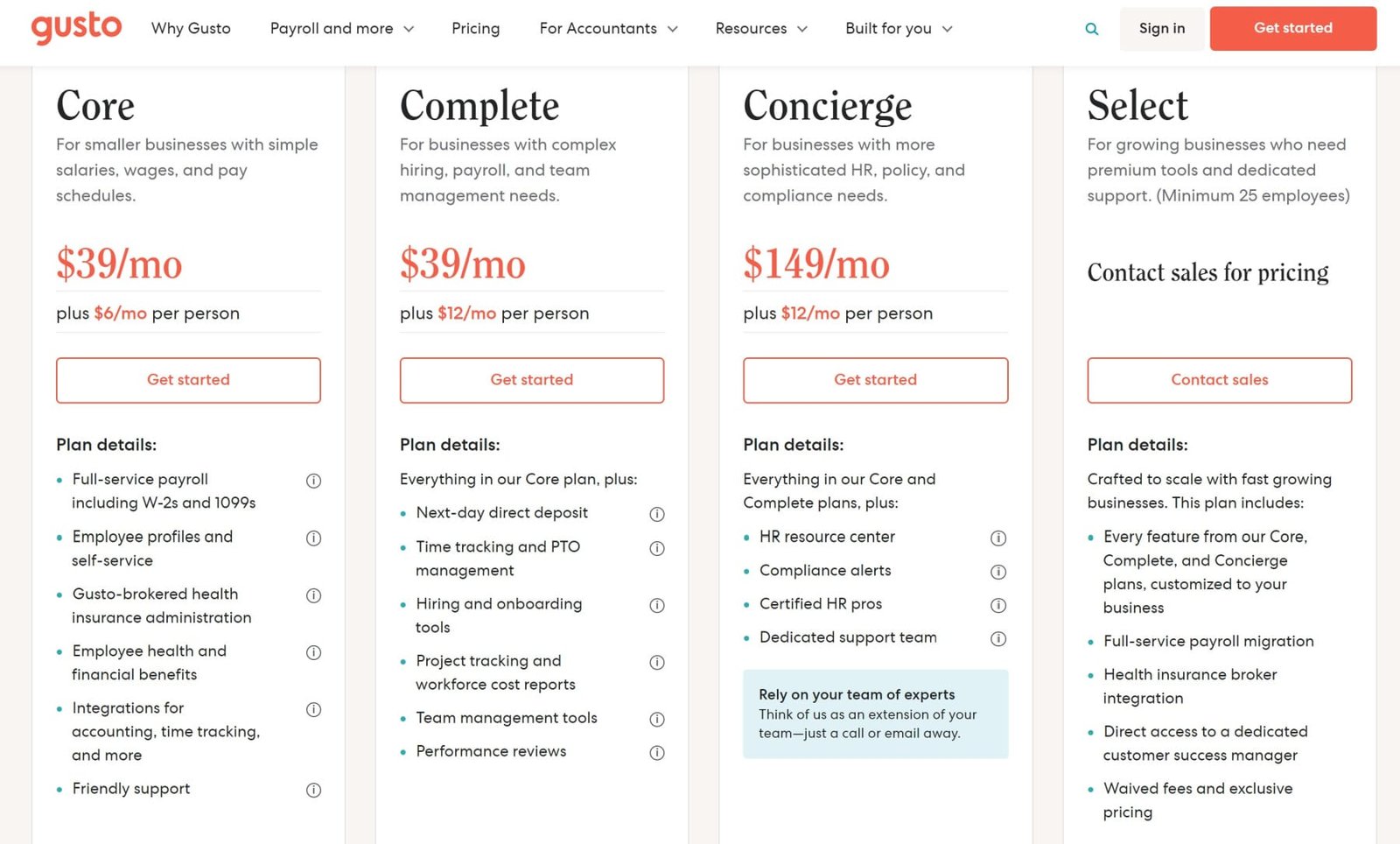

There are three options to choose from. Each of them has different prices and can be customized to suit your needs. At $39 per month with an additional $6 per employee, the Core Plan isn't among the lowest-cost plans we looked at, but it's reasonable and comes with everything you need to manage payroll.

Gusto offers three plans that include automatic payroll for salaried employees. They also provide unlimited payroll runs, direct deposit, tax filings along with W-2s and 1099s.

Gusto offers health insurance in all states and you can utilize it to design an employee benefits package for employees. The more expensive plans from Gusto also include time tracking as well as other HR and administrative functions. Gusto offers a Contractor Plan to companies without W-2 employees. The monthly cost is $6 per employee.

Is Gusto Right for Me?

Gusto Is Best For:

- Companies that have to declare taxes in more than one state

- Tech lovers

- New businesses

- Companies that are paying independent contractors

- People who dislike additional fees

Gusto is not advised for: Businesses searching for the cheapest self-service payroll software

- Individuals who wish to manage household payroll

- Users who want expert assistance during the evening hours or on the weekend

If you're into UX and love using the most recent apps, Gusto might be a suitable choice. Gusto was founded in Silicon Valley and has a contemporary look. You can not only manage your payroll, you could also track your employees' coffee purchases and even send birthday cards, signed by colleagues.

Unlike some competitors, we reviewed, Gusto doesn't charge extra fees if you need to pay taxes in more than one state. The pricing for Gusto can be found on their website. If you are apprehensive about paying extra costs that drive you crazy, this may be the right fit for you.

Gusto is an ideal choice for businesses that are just starting out because you can create benefits packages as well as set up payroll and onboard employees all in one place and at a cost-effective price. Gusto's self-onboarding. Gusto requires only some basic information about your employees.

Then, Gusto will send an email instructing them to log in and complete the remainder. Another advantage of signing up with Gusto is the ability to upgrade or decrease your plan at any time. If you're paying solely independent contractors, you may think about Gusto.

Gusto has a plan that comes with no fee for monthly payments that exceed $6 per payee, however, it does not provide household payroll.

Gusto is not the best choice the right choice for you if someone would prefer to be in a position to call and get answers to your questions immediately.

Live support is accessible between 7 a.m. until 4 p.m. PST. Contrary to this many competitors on our list offer 24/7 support, while others offer evening or weekend hours depending on the location you're in.

Gusto does not have a mobile application to manage payroll, however, you can log in using a web browser from your phone or tablet. Finally, Gusto isn't the most expensive payroll software we've seen in our rating of the Best Payroll Software in 2022, but it's also not the most affordable.

With self-service plans like Patriot or SurePayroll, it is necessary to file your own taxes and you won't get much HR software assistance but you'll save money.

Core

The Core Plan costs $39 per month, plus $6 per employee. The Core Plan includes everything you need to run payroll including direct deposit and payroll reports, as well as unlimited payroll runs and unlimited payroll runs.

Gusto can also handle your tax filings, whether they're state, federal, or local. It also lets you manage benefits, and employees will be able to access their W-2s as well as pay stubs with Gusto Wallet.

Gusto Wallet App. If you require additional HR features such as time-tracking, software provisioning, and surveys that are anonymous, think about upgrading to Gusto’s Complete or Concierge plans.

Although this plan is the most cost-effective of the options offered by Gusto you must consider other options like Patriot and SurePayroll if you want to have self-service, low-priced payroll software.

Complete

The Complete Plan from Gusto costs $39.90 per month, with an additional $12 per employee. It includes everything you get with the Core Plan and more. The biggest difference in running payroll is the fact that the Complete Plan offers next-day direct deposit. But when you check out the options that go beyond payroll, there are some significant variations.

The Complete Plan has added functions such as the option of e-signing documents, customized onboarding checklists as well as time-tracking PTO requests, and the capability to create anonymous surveys and even review the results in the course of time.

If you're in need of more HR support, consider upgrading to the Concierge Plan. The plan not only comes with unlimited access to a certified HR professional over the phone or chat as well as an exclusive phone number that you can use to get support for customers.

Concierge

Costing $149 per month and $12 per employee, Gusto's Concierge plan is more expensive than the plans we evaluated However, it has numerous options, including all the tools needed to manage payroll and manage benefits. You get the same features as the Complete and Concierge plans when it comes to running payroll.

The Concierge plan, however, includes HR support that is premium. Gusto's HR Resource Center will give access to. It includes job descriptions as well as templates to help you implement employee policies. You will also receive updates on changes in the law so that you are always compliant.

You also have unlimited access to HR experts and a phone number so that you can reach Gusto for assistance.

Gusto vs Competitors

Gusto vs Onpay

Gusto is the best choice in our ranking of the Top Payroll Software of 2021. It is just ahead of OnPay which is ranked in the top ten. 2. Both are excellent products, however, there are some things you need to think about before deciding which one is right for you.

They both offer expert assistance as well as everything you need to manage workers' compensation administration and payroll. Gusto and OnPay offer a range of integrations.

OnPay costs $36 per month and $4 per employee, which is slightly more affordable than Gusto Core Plan. OnPay provides health insurance in all 50 states in the United States, while Gusto doesn't offer it in every state. Check its current list before signing up if this feature is important to you.

With OnPay, it can take up to four days for your employees to receive their direct deposits, while Gusto offers next-day direct deposit with its Concierge and Complete plans. All of Gusto's plans also come with federal as well as state and local tax filings, while OnPay just fulfills your federal and state tax obligations. OnPay offers just one plan, and it's obvious that there's a big difference in price between it and Gusto's Concierge option.

There are also significant differences in the quality of service. If you're looking to access experienced HR professionals who are certified, look into Gusto.

Gusto vs Square

Gusto and Square are ranked first and fourth respectively in our ranking of the Top Payroll Software of 2021. Both provide all the payroll tools that you need including direct deposits, unlimited payroll runs, and W-2s. Both also pride themselves on offering straightforward pricing without extra charges.

However, there are several major distinctions between Gusto and Square. Square also offers plans that cost $29.95 per month for each person. It's slightly cheaper than Gusto Core Plan. Square is well-known for its Point of Sale (POS) systems.

Employees who already use the POS system to log in and out claim it's made payroll simple. Square also offers tools to manage your team, operate an online store, establish loyalty programs, manage inventory, and other useful options. Gusto provides a fantastic option for companies that require more HR support.

Square is a good alternative for businesses that require business administration. Gusto's Concierge plan is quite a bit pricier than Square, but users have unlimited access to HR specialists by phone or via chat.

With all its plans, Gusto will prepare your federal, state, and local payroll taxes, while Square just takes care of your federal and state filings. Square as well as Gusto also has a plan that allows you to pay contractors who are independent without monthly charges. Check out these products if are interested.

Gusto vs Paychex

Gusto scored a 4.3 in our ratings for the Top Payroll Software of 2021. Gusto was placed the number. Gusto was rated No. 1 in our ratings for the Top Payroll Software of 2021. Paychex was ranked eighth, with a score of 3.6. It all comes down to the needs of your business. Both offer everything you require to run payroll, but there are some big differences.

Gusto's Core plans start at $39 a month, including $6 per employee and the basic plan offered by Paychex starts at $59 for a month, with a fee of $4 per employee. These are the same amount per month if you're paying 10 people, but the rates could differ due to the fact that Paychex offers add-ons.

Gusto, however, boasts transparency in pricing. Gusto supports many software integrations however, with Paychex, you'll need to pay extra to integrate the accounting program unless you go with its most extensive plan.

Gusto's Complete Plan, which is priced at just $39 per month plus $12 per employee, includes additional features such as time tracking, employee surveys, and customizing permissions - but without the cost of a major increase. Paychex offers health insurance benefits across the 50 states of America.

Gusto is unable to provide this benefit at the moment. It also provides professional support 24/7 via the telephone, and its enterprise plan is able to accommodate large firms, while Gusto is designed for smaller enterprises. Paychex is an option when you think your business to grow rapidly. Both Paychex and Gusto have a wide range of HR features, but the ones offered by Paychex are more effective if you're willing to purchase them.

Gusto is cloud-based, which means you can sign up online, and there's no commitment to signing a contract.

Gusto offers three plans with various features and prices. It also offers an option for companies that employ independent contractors. Contact the Gusto sales team by chat or by phone to help you decide the best plan for you. You will need your EIN number, as well as the addresses and the salaries of your employees as well as records of any payroll taxes that you have already paid.

1. Select a Plan Take note of which plan is the best for you prior to signing up. Be aware that the Core Plan has everything you need to run payroll. Additionally, Gusto will help you file local, state, and federal taxes. The Complete Plan comes with added features to help you run your business better, including time tracking. And the Concierge Plan includes access to HR professionals who are certified in the event you require they are needed.

2. Register. Once you've chosen a plan, click the orange "Get started" button on Gusto's website. You'll be asked to sign up for your own Gusto account.

3. Create an account There are 10 steps required to establish your account. Enter your address, details about your workers, tax information, and banking details. Choose a payment schedule and enter your previous details for payroll, sign a few forms, confirm your bank details, and then add your tax liabilities that are currently unpaid.

Gusto FAQs

Does Gusto Offer a Trial Period?

Contrary to other payroll applications in our ratings, Gusto doesn't offer a trial for a free period. You can cancel Gusto at any time. Gusto does have a demo available on its site so that you can test the service about it prior to making a decision to sign up.

Does Gusto Offer Direct Deposit?

Gusto offers direct deposit with all three plans, so you can directly transfer funds to your employees without printing or signing checks. With Gusto's Core Plan, you need to run payroll for at least 2 days prior to the date of payday.

Gusto's Complete and Concierge plans come with direct deposit on the next day. Your employees will get an email congratulating them on their paydays from Gusto and include an online link to the pay stub. Certain customers can also be eligible for Gusto Cashout. A useful tool that lets your employees request an advance to cover emergencies.

Does Gusto Offer Automated Tax Filing?

With all three plans, Gusto will complete and pay your federal, state as well as local taxes. Gusto generates your W-2s, 1099s, and then distributes them electronically to your employees at the end of the year. Gusto is an excellent option for companies that have to file multiple tax returns. Multistate tax filings are available in all three plans. this is not something that all payroll softwares can boast about.

Can Gusto be capable of tracking time?

Gusto's Complete and Concierge Plans allow you to monitor the hours of hourly employees and salaried employees. You can also track projects and allow your employees to submit PTO requests. The system will automatically sync to your calendar.

Gusto is also able to integrate with many time tracking software. This is helpful if you're using one you like or you decide to go with Gusto's Core Plan, which doesn't include time tracking.

Does Gusto Support Integrations?

Gusto offers a variety of integrations. The ability to sync your accounting software with Gusto will help you save time and allow you to be focused. With Gusto, it is possible to integrate all of the top accounting software, including Intuit QuickBooks, FreshBooks, and Xero.

Gusto supports integrations with time-tracking software such as Tsheets, Homebase, and when I work. Plus Gusto does a lot more. You can also incorporate a wide variety of Point of Sale, business administration analytics, HR, and many other programs.

Does Gusto Have a Mobile App?

With Gusto Wallet, the Gusto Wallet app, your employees will be able to access their pay stubs, tax documents, create cash accounts, and many more. It's available for Android as well as Apple devices.

Gusto doesn't have a mobile application to manage payroll, but you are able to perform the task on your phone or tablet. Log into your Gusto account with your internet browser. To adjust benefits, change clock-in/out times as well as request PTO and other tasks, employees will have to log in to Gusto using a web browser.

How do I get in touch with Gusto's customer support?

For all three Gusto plans, you have access to support for customers. You can contact them via phone, chat, or email for assistance. Support is accessible anytime between 7 a.m. to 4 p.m. PST. There's a priority number for customers on the Concierge plan who also have access to an expert team. Gusto's Help Center is available to help you solve your problems by yourself.