Incfile vs. LegalZoom – Who is the best LLC formation service for the year 2022. In this Incfile review and comparison with Legalzoom, we examine and find all the available services, pricing, and plans for these two business formation services.

Incfile vs. LegalZoom

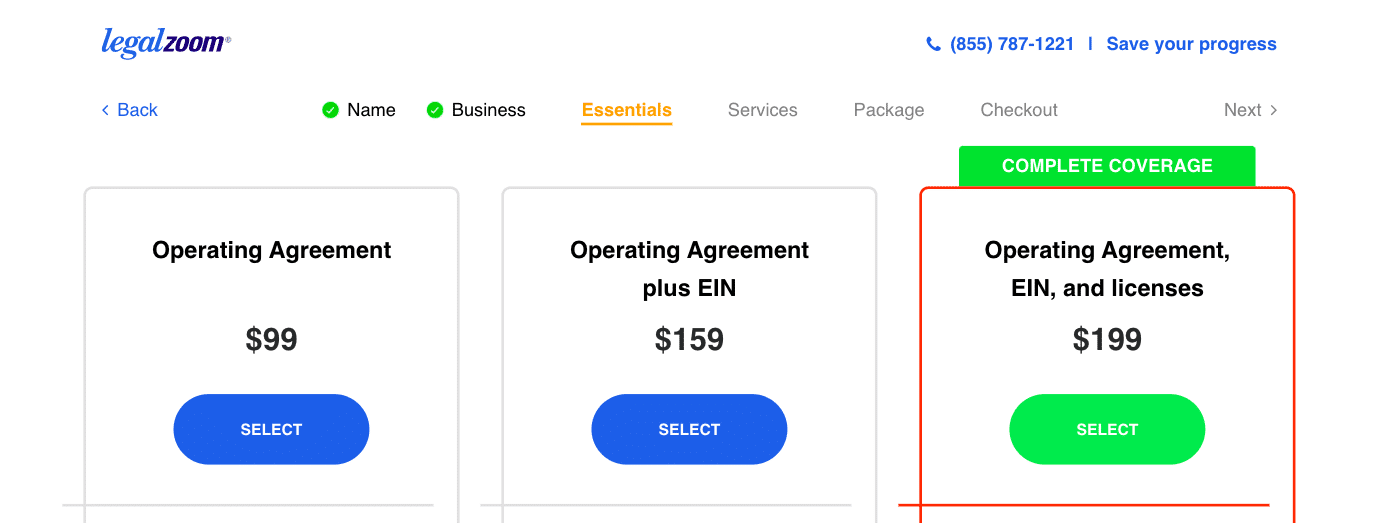

LegalZoom ‘Express Gold Plan’

$349 LLC Filing, Formation

$159 LLC Operating Agreement + EIN

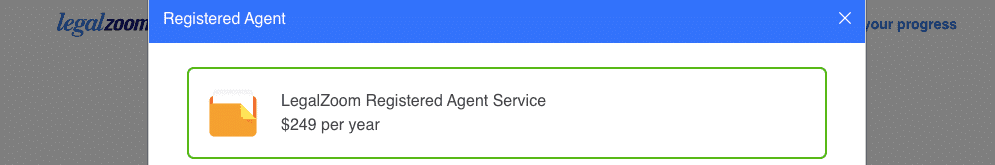

$249 Registered Agent Service One Year

$69 Compliance Calendar Reminders

= $826. + state fee

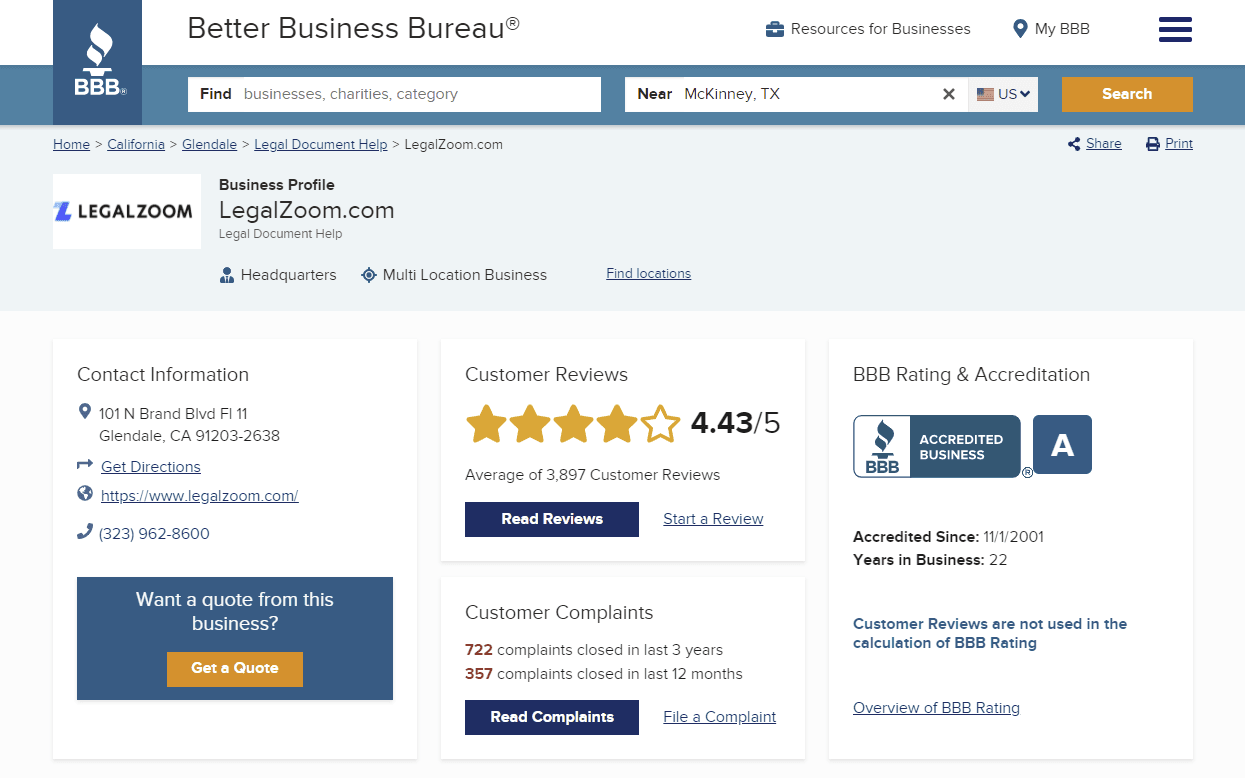

LegalZoom BBB Reviews

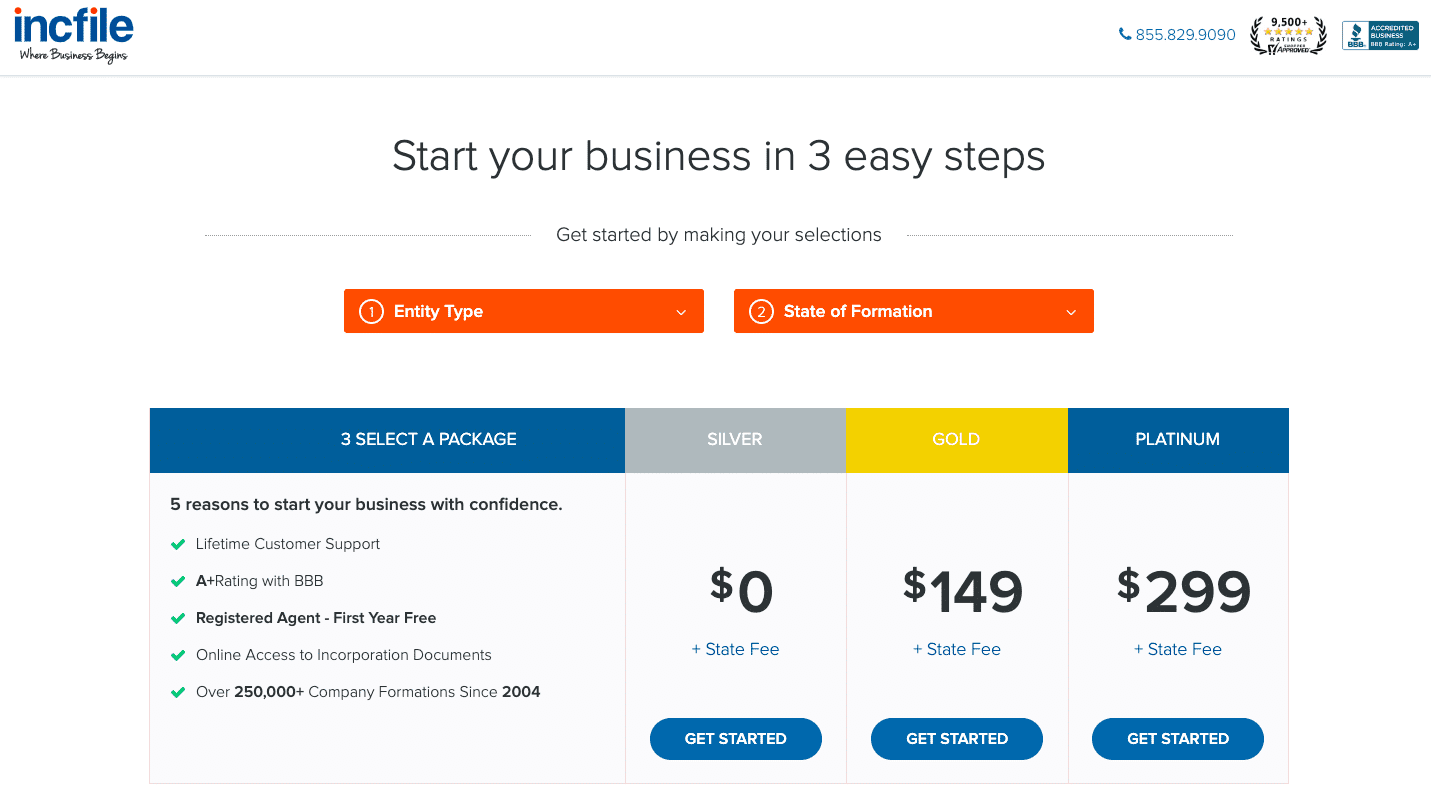

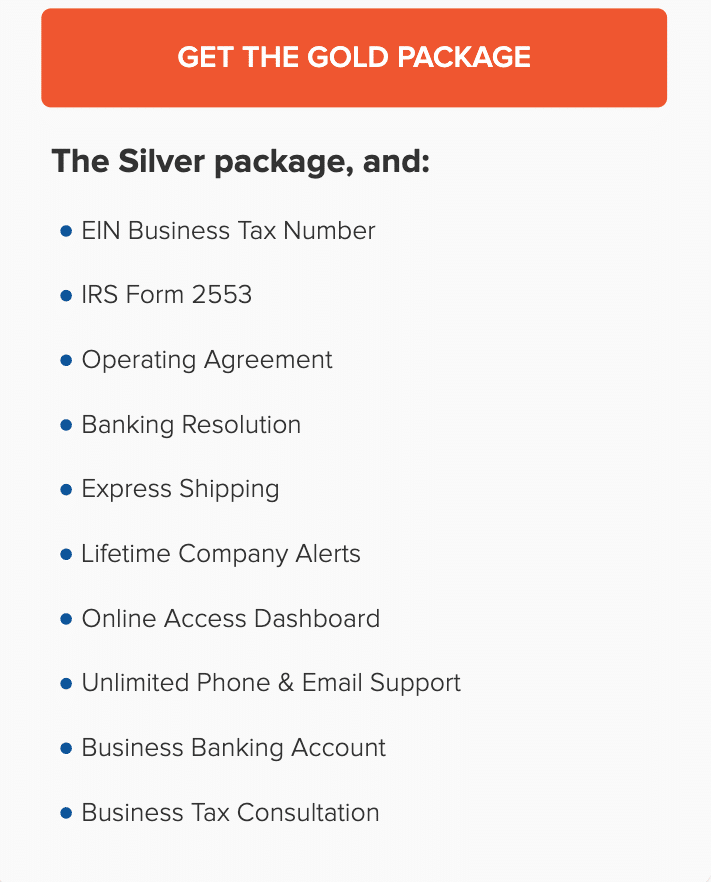

Incfile ‘Gold Plan’

LLC Filing, Formation, LLC Operating Agreement, Employer ID Number (EIN), 1st Year Registered Agent Service, Compliance Reminders

= $149. + state fee

Winner Alert!

Incfile Editor’s Choice!

Incfile $149 + state fee

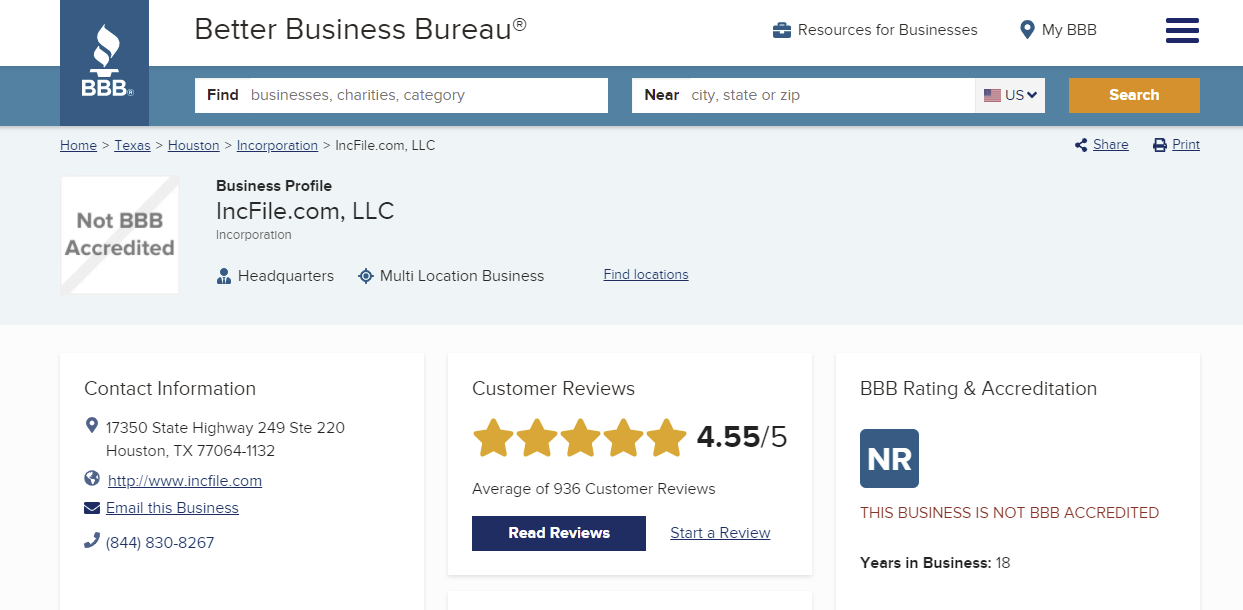

Incfile BBB Reviews

Incfile has 936 BBB reviews with a total rating of 4.5/5.

The past few years have been a heyday for many startups. Any feasible idea springs up to become a company, and online legal services such as Incfile and LegalZoom are behind many of those new companies.

Visit our Top 8 Best LLC Services

Starting a company requires more than the basic idea and funding. It involves plenty of paperwork and some legal know-how that not many entrepreneurs have knowledge in, nor have the time to do so.

Online legal services like Incfile assist startups or running businesses with their legal requirements so that the founders can concentrate on the business side.

Business attorneys can cost up to $400-$500+ an hour; this is one reason why entrepreneurs are choosing online legal and document filing services. This article will examine the similarities of Incfile vs. LegalZoom and point out some of the differences, including prices and customer satisfaction.

Incfile was founded in 2004, and its headquarters is located in Houston, Texas; since then, they have already helped over 500,000 entrepreneurs start their companies. That large customer base makes Incfile a company that can be trusted to help build your company.

Through Incfile, legal assistance to start your company doesn’t cost much. Starting formation prices are $0.00 plus whatever amount your state charges for a filing fee.

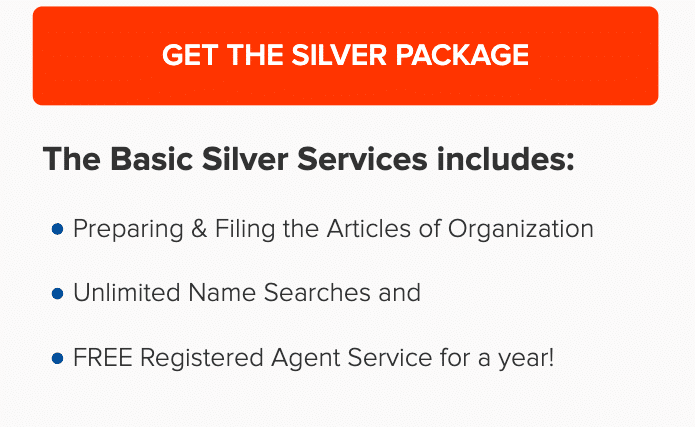

For $0.00, Incfile’s starting package (Silver) includes the following:

- Check for company name availability – to check if the company name has already been taken within the state. Much like domain names.

- Preparation and Filing of Articles of Incorporation – Incfile will be the one to prepare your incorporation documents based on the information you provide and will also do the filing to the state.

- Free Business Tax Consultation – a free hour-long professional business tax consultation.

- Next Business Day Processing

- Online Order Status Tracking

- Registered Agent Service – free for the first year but costs a still affordable $119 for every succeeding year.

Although Incfile is an online legal assistant, Incfile concentrates on helping new businesses get incorporated, whether it’s a Limited Liability Company, S-Corporation, C-Corporation, or a non-profit organization.

According to Entrepreneur Magazine, it’s been around long enough to be trusted and has enough experience to become one of the 360 Best Entrepreneurial Companies in America.

Incfile’s Silver Formation Plan

Incfile’s Gold Formation Plan

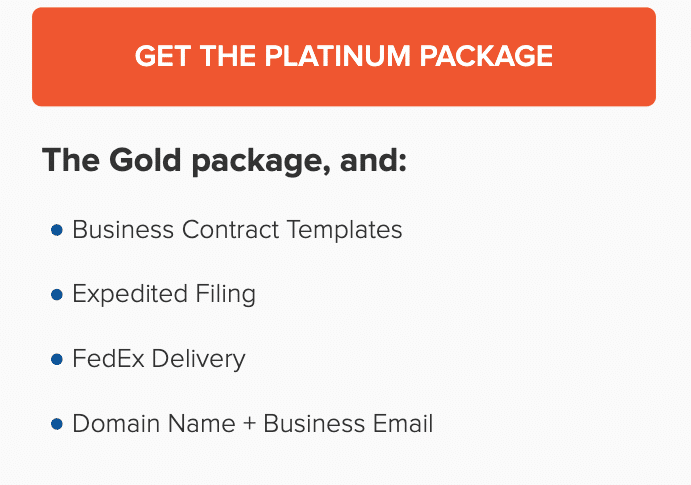

Incfile’s Platinum Formation Plan

- filing annual reports regarding the company’s members, leadership, and business addresses

- preparation of a certificate of good standing which validates the status of a company which is required for some transactions

- determining other required business licenses and permits

- assistance in trademark/brand registrations of the company name, brands, logos, and taglines

Of course, there might be changes along the way to incorporation or while the company is already in operation. Incfile can also help with:

- Company amendments such as member changes, changes of the business address, and even the company name

- Foreign qualification in case the business needs to expand to other states

- Company dissolution

After helping set up the company, Incfile is ready to assist with the company’s taxation needs. Incfile can help assist in acquiring your company’s EIN or Tax ID Number. An EIN is required by companies for tax filing and setting up the company bank account, which Incfile can easily acquire in as short as one day.

Moreover, then comes the dreaded tax day where individuals and companies compute and file their income tax. Allow yourself and your business a worry-free tax day as Incfile will be doing most of the work, such as filing the required LLC tax forms, S Corporation tax, and C Corporation tax requirements.

So with Incfile, companies need not worry about small legalities and focus on their core business. There’s no need to hire attorneys or expensive law firms.

Incfile LLC Service vs LegalZoom LLC Service

Incfile isn’t the only player on the web when it comes to online legal assistance. The other well-known player is LegalZoom. What is the difference? Why should you choose one over the other? Note them below and decide according to your company’s needs.

If your company’s legal requirements go beyond incorporation and taxation, it’s LegalZoom from the get-go. If you want to focus on LLC formation, registered agent services, and business taxes, Incfile is the one to go with.

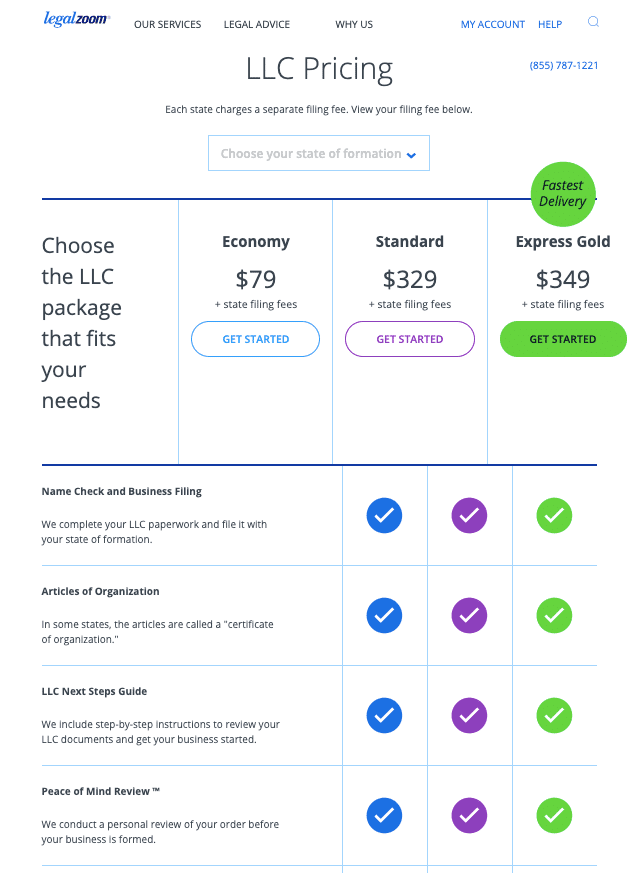

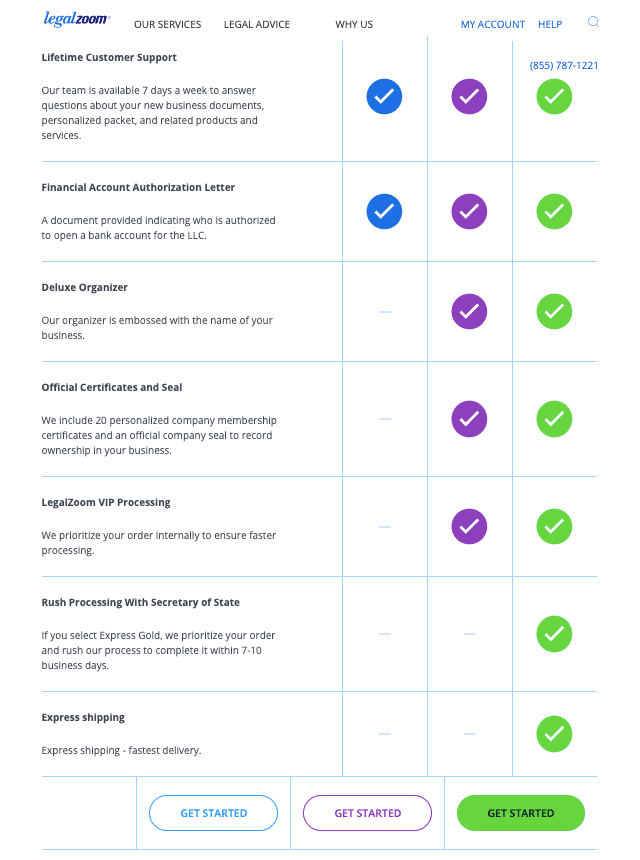

LegalZoom LLC Formation Pricing

LegalZoom formations start at $79.

But what about LegalZoom’s Registered Agent Services?

What about LegalZoom’s Operating Agreement & EIN? (Employer Identification Number)

These are not on the above list, but they can be found as add-ons

In my opinion, LegalZoom seems pricey!

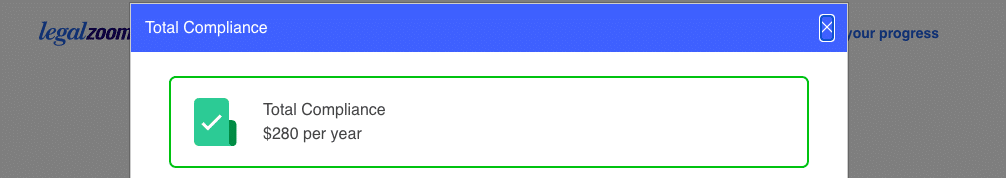

LegalZoom’s “Compliance Calendar”

LegalZoom has a “Compliance Calendar” feature to remind customers of due dates, compliance, and requirements. They charge $69 per year.

I’m not sure if this is replacing the “Total Compliance” feature for $280.

The LegalZoom website in 2021 continues to offer “Total Compliance” with the Express Gold Package for $280.

BTW – Both Incfile and ZenBusiness provide this type of service at no additional charge in their popular LLC packages.

Note – These LLC services can change their pricing and features at any time; we suggest readers do their due diligence and research.

Incfile’s LLC formations start at $0.00 and include registered agent services for free for the first year. But after adding the additional services that most people need, like getting an EIN and operating agreement, the most popular Incfile plan is just $149. and provides many more services than LegalZoom does.

Incfile’s list of services

- Business formation through LLC or corporation filing

- Trademark Registration

- Filing of Business Taxes

- Business Compliance

LegalZoom’s list of services

- Business formation through LLC or corporation filing

- Trademark Registration

- Business Compliance

- Speak with an attorney

- Custom Legal Forms

- Wills and Trusts

So both companies can help with company formation, trademark registration, and business compliance. Incfile is more affordable than LegalZoom, which starts at $49 versus LegalZoom’s $79.

Business compliance, however, is more expensive, with Incfile at $88 versus Legalzoom’s $55. Incfile has also competed with Legalzoom in terms of Trademark registration with equal pricing.

When it comes to registered agents, Incfile remains cheaper than Legalzoom. Incfile also does business taxes; therefore, Incfile is beginning to sound right regarding company formation.

Legalzoom, on the other hand, has had over one million LLC clients versus Incfile’s 500k, making it almost a household name when it comes to legal assistance. Legalzoom could floor Incfile if it improved customer service and also handled business taxes.

Legalzoom can do business taxes and its monthly legal plan though Legalzoom outsources this service to tax professionals who may go the full mile for an added fee.

Incfile’s most significant advantage over Legalzoom is customer service and pricing. And when it comes to business formation, Incfile also wins with the speed of formations. All of Incfile’s package tiers have next-business-day processing.

As for Legalzoom, all its package tiers are equal except for the rate. The most expensive level in Legalzoom nets a result in 10 business days while the cheapest goes for up to 35 days.

Incfile Provides A Tax Service For Your LLC

The best advantage of LegalZoom over Incfile is custom legal forms, which Incfile does not support. Clients can help with legal forms other than incorporation, such as contracts and other legal forms, which are very important in any business. Another advantage of LegalZoom is regular legal advice from attorneys as part of a monthly legal plan.

Incfile

- Next business day processing for business formation papers

- Does business taxes

- No weekend phone support

- Additional features and services per tier

LegalZoom

- The fastest business formation processing takes ten days

- Business tax consultation included in the monthly legal plan

- Phone support is also available on Saturdays

- Equal services for all levels

- Creation of custom legal forms

- Contact attorneys for legal advice through a monthly business legal plan

- Other services include work visas, real estate, marriage and divorce, bankruptcy filing, and estate planning.

Incfile Strength’s and Weaknesses

Incfile’s Strengths

We’ll be discussing Incfile’s main pros and cons below. This list may not be comprehensive but it will help you determine if Incfile is the right choice for you.

1. Pricing for LLC formations is unbeatable

It is very difficult to beat a zero-dollar filing. Operating agreements templates are available online for free, even though they are bare bones.

- This ultra-light package is great if you intend to use other services in your operating agreement.

- Incfile Free LLC

- Incfile’s Gold plan is the best on the market and comparable to ZenBusiness.

Incfile claims that documents are typically sent to the state authorities within one business day. This is a remarkable turnaround time considering the price.

Incfile also offers solid prices across the board for many of its basic services. After the first year, Incfile charges $119/year for its registered agent service. This price is comparable to other competitors.

Incfile’s DBA/Fictitious business name, Certificate of Authority and business license search services all come at or below the average prices of their competitors.

You may prefer specialist companies for other services such as trademark registration. They offer lower prices.

2. Quick Turnaround Time

Incfile guarantees that all LLC documents, regardless of whether you choose the cheapest or most expensive bundle, will be delivered to the state authorities within one working day. We love that Incfile doesn’t charge extra for priority within its internal system.

Incfile is no longer responsible for the Articles of Organization once they have been sent. Incfile has a handy tool on its website that will show you the processing time of each state for your LLC application. The average time it takes for most states is between 2 and 3 weeks.

This tool will also show you the cost of expedited filing times in each state and the speed at which an expedited application can be approved. This time period is usually between 2 and 5 business days for most states.

3. Helpful online dashboard

The formation of an LLC can involve many moving parts. There are many forms that must be filled out, each one with a different agency and each on a different timeline.

It can be difficult to keep up with all the start-up work, especially when you are trying to set up your business.

Incfile Online Dashboard

Customers of Incfile will be able to access an online dashboard which provides concise information about order statuses, deadlines and stores that have previously submitted and drafted documents.

You’ll also receive text and email notifications. Additionally, you will be sent “order updates” and compliance alerts via your custom business management dashboard.

Incfile’s online dashboard is an excellent tool for helping you to establish and maintain compliance.

4. It is simple to use

Incfile’s interface is solid and should be easy to use by most users. It takes just a few steps to file for an LLC or another type of business.

Incfile’s pages will automatically populate prices based upon the state where you are filing. This means that you won’t get a surprise price bump when you checkout.

Similar procedures can be used to order additional services such as a name modification/amendment, or a license search. Incfile provides easy-to-read writing guides for these services.

The website Incfile (Incfile.com) is easy to navigate. You don’t need to scroll through pages to find the information you are looking for.

Incfile’s Weaknesses

These are the areas that Incfile should improve, according to our opinion.

1. Mixed customer reviews

Incfile’s Reviews & Customer Services Page highlights the 4 out 5 star rating that they have received on their Facebook page.

On Approved Shopper Incfile has 38,000 customer reviews with a total rating of 4.8/5

However, customer service is the most frequent complaint. Many customers complained that they found it difficult to reach someone who could help them.

This may not surprise considering the company’s small size and its vast service area.

2. Cancellation and refund policies are not easy to access

Incfile’s cancellation and refund policies, as mentioned previously, are not as accessible as we would prefer.

You will need to dig a little deeper to find out the refund policy window. You’ll discover that most services have a $30 cancellation fee.

It is not possible to immediately access language regarding the renewal terms for annual services. These services are generally renewed automatically, with the exception of registered agent services after your first year. You can opt in or out of this service.

Although cancellation and refund policies are not applicable to all customers, we would still like to see clearer language.

3. Average customer service

Incfile’s customer service (or lack thereof) seems to be a problem, as mentioned in the “mixed Customer Reviews” con.

According to the company, it provides phone support between Monday and Friday from 9 – 6 CST. We would love to have weekend support hours.

Incfile mentions that they have recently increased their customer support options. Incfile mentions that they have doubled the customer support staff, and that they have added an interactive help service along with a live chat option.

Incfile Customer Support Improvements

These moves could improve Incfile’s customer service moving forward, if true. However, a “doubling” of customer support staff is still ambiguous – technically, going from one support representative to two is a doubling!

Incfile Services

Incfile offers a variety of services, including LLC formation and related services (e.g. Incfile offers a number of services, including registered agent service and LLC formation. We’ll be looking at some of Incfile’s most popular services in more detail below.

We will explain which services are available and when you might need them. In parentheses will be Incfile’s price range for each service, excluding state fees.

Business Formation $0 – $299

For something as simple and straightforward as forming an LLC, it can be hard to understand the regulations. It can be difficult to navigate the process by yourself. This could cost you valuable time.

You can also file through Incfile, an LLC formation company. They have the experience and expertise to make sure your filing goes smoothly.

Check the Secretary of State website to see if your business name is still available. Many of these websites offer a free search tool and compare feature. Check out the US Patent and Trademark Office’s database TESS, which is available here.

It is easy to file your LLC online with Incfile. A series of questions about your future business will be asked. Name, address, and member details of your business.

Incfile will ensure that your paperwork is filed within the next business day.

Although Incfile’s basic package is free, each state charges a filing fee to form an LLC. The fee can vary from $40 to $500 depending on where you live. Incfile automatically populates the checkout price tab when you enter your desired filing status. This is the first step, so you will immediately know the final amount.

Once all necessary documents are sent, the state will process them. The processing time depends on the state and the year.

Incfile also allows you to file articles of incorporation as an S-Corporation or C-Corporation. Each of these are very similar to filing an LLC.

Number of EIN

In Gold and Platinum Packages

A federal tax ID number is required for all US-based businesses. Also known as an employer identification (EIN), it is also called an employer identification number (EIN). This number is used by the IRS to track and identify business entities.

Your EIN can be thought of as your company’s social security number.

An EIN is required for several situations. If your company is going to employ employees, pay excise taxes, or if you have to comply with state laws, an EIN will be required. EINs are required by most banks to open business bank accounts.

Incfile can obtain your EIN as part of their Gold Package.

You can get an EIN online in just a few seconds through the IRS Website. It is generally best to apply for an EIN yourself. Incfile’s Gold package doesn’t offer any additional value.

Registered Agent Service: One year free, $119/year thereafter

Every LLC and corporation must designate a registered representative when they are formed. A registered agent is a point-of-contact for service of process. This includes any official legal notices such as court summons that you will need to respond quickly to.

You could lose your certificate or face other consequences if you fail to appoint a registered representative.

The registered agent must reside in the state where your LLC is located. To receive any important documents, they will need to be available during normal business hours. Publicly available are the addresses and names of registered agents.

You have the option to act as your own registered agent, or hire a professional service. If you have the following reasons, you may want to use a registered agent service:

- You frequently travel and you may not be at one address.

- You are not a citizen of the United States

- Your business may be located in several states

- Your name and address are not to be made public.

Incfile provides a registered agent service that includes a year of free registration with any purchase of Silver, Gold, and Platinum packages.

Incfile will act as your registered agent and receive all business mail for you. You will also receive notifications about documents received. Important information can be accessed through the digital dashboard.

Incfile’s registered agent services cost $119/year after the first year of free.

Operating Agreement

Includes with Platinum and Gold packages

An operating agreement is an essential document. It is the agreement that the LLC member(s), or any other entity, agrees to the operating rules and the rights of the LLC members. It might include:

- How to manage the LLC

- How ownership is split among members

- How are profits paid out

- What happens if one of the LLC members wants to leave, or if the member dies?

- …and many more important questions

Operating agreements are not required by every state. Even if you don’t need one, it is a good idea to have an operating agreement.

A basic operating agreement can help protect your LLC’s limited liability status. It provides clear guidelines for what to do in case of an unexpected event.

You must sign an operating agreement if you plan to establish a business in California, Delaware or Maine, Missouri, New York or Maine.

Your operating agreement does not have to be filed with the state. It should simply be kept in your possession.

Annual Reports $99

Many businesses are legally required by law to file reports with their Secretary-of-State offices, typically annually.

These reports usually include basic information about the LLC such as its address and the names of its members or managers. These reports are used to assist state authorities in keeping track of businesses operating under their jurisdiction.

Although it can be tedious, filing an annual report will help avoid penalties and keep you in good standing with the state.

Some states have a deadline for annual reports. Some states require that you submit your annual reports by the anniversary of the date you established your business. For example, if your company was formed in November, then your first annual report is due next November. Some states only require that you file a report once every two years.

Most states charge an annual filing fee. Most fees are under $100 and they tend to be very modest. This fee will be charged regardless of whether your LLC has earned any revenue in the previous year.

Although annual reports don’t seem to be very important, failure to file or pay the fees on time could result in your company being liquidated. It is crucial to make sure that you pay your filing and payment on time.

Incfile can help you fill out your annual reports. Incfile will transmit your report to the appropriate state authorities once you have entered all the information. You will also be notified when your report is received and accepted by the state authorities.

S-Corp Tax Election $50

S-corp is short for “small business corporation”. S-corp can be thought of as a small business corporation. However, it is not the same as an LLC.

Some businesses find it beneficial to be treated as an Scorp, while others may not. To determine if filing as an Scorp is beneficial for your business, consult a tax expert.

It is important to remember that you can always choose to be treated later as an Scorp – your status of an LLC doesn’t have to be fixed.

Incfile will handle all paperwork necessary to file an S-Corp Election with the IRS for $50

Request a Business License $99

You may need to comply with a variety of regulations depending on the size and industry of your business. Permits and licenses may be required at all levels: local, state and federal.

It can be difficult to keep up with all the regulations, but it is necessary. It is not a good idea to run afoul the law and put your business’s future in danger.

Incfile provides a “Business License Search” service for a set fee. This service compiles a list of applicable permits, tax registrations and application forms after you have provided information about your business.

Incfile claims that the research package for their state-approved research will be sent to your within five days of filing by your company with the state.

Important to remember that Incfile’s business licence search will not provide you with the documents you need, nor information on how you can fill them out. You still have to complete them yourself. This service is a good deal for people who don’t want to spend too much time researching.

Qualified Foreign Workers $149

The term “Foreign Qualification” does not mean that you are internationally qualified. A Foreign Qualification is required when you do business in a country that you are not a member of.

You can apply for a Foreign Qualification to receive a Certificate of Authority, which basically gives you the right to operate in “foreign” states (i.e., one other than that where your business was founded).

Expansions may require multiple Foreign Qualifications. Each state requires a Certificate of Authority. Incfile will file your Foreign Qualification in one state for a once-off fee. Incfile’s pricing is comparable to its competitors.

Amendments and name changes $99

Sometimes amendments to the Articles of Incorporation may be necessary. Perhaps your business wants to change its name or address or add new members.

You will need to amend your Articles of Incorporation to reflect these significant changes.

Incfile can file this amendment on your behalf. Once you have entered the information required to amend, Incfile will send the appropriate documentation to the state authority. It is often slower to process amendments than Articles of Incorporation. This means that even though Incfile may send your forms quickly, it could take several weeks before you receive confirmation of your alterations.

Certificates of good standing $49

A Certificate of Good Standing, issued at the state level, is a document that certifies that your company is current with all filings, fees, or other requirements.

This document is not required to continue operating your businesses. However, it is essential if your business is expanding to other states or you are looking to liquidate your business. Clients may request a Certificate to Good Standing in order to verify that you are up and running.

Incfile will file a Certificate for Good Standing in the state you choose (must be the same state where your LLC is registered). Incfile’s pricing for this service is reasonable, and it costs less than its competitors.

DBA/Fictitious Business Name $99

A Fictitious Business name – also known as a “Doing Business As”, (DBA), Trade Name or Assumed Business name – allows you and your business to operate under a different name than the one listed on your articles.

Fictitious business names can be used to protect your privacy, increase name recognition, or account for a shift in or expansion of your business.

Imagine, for example, that you start a custom cabinet-building company under the name Superb Cabinets LLC. You may also take on additional carpentry jobs as your business grows. You may file for a Fictitious business name, such as Superb Home Carpentry LLC, to reflect the expanded offerings.

Incfile will file your DBA/Fictitious business name request with the appropriate state authority for a flat fee. The price they charge for this service is comparable to other companies.

Fictitious business names are not allowed in all states. Incfile’s DBA/Fictitious Name Page has a list of states that allow them.

Trademark registration $199

Trademarks are a way to protect intellectual property that distinguishes your company from others. Trademarks can be used to trademark taglines, designs, or single words.

Incfile will file your trademark for a nominal fee (limited to one class and one series) for you business. Incfile states that filing takes between 3-7 days and federal approval takes about 3-4 months.

Although you might find Incfile convenient if you already use their services, Incfile’s $199 plus federal fees price point is not very competitive.

Specialist companies may be better if you are serious about filing trademarks.

Bookkeeping, accounting, and business taxes

Pricing varies

Incfile offers bookkeeping and business accounting services. Although they claim to have a range of packages available, prices are not easily accessible on their website. Instead, the main call-to-action is a “Get A Free Tax Consultation”.

Incfile claims that their packages include quarterly bookkeeping and unlimited tax consultations with tax experts. They also offer the ability to file at least one tax return.

Bookkeeping is essential if you want to maintain your company’s finances in order. A well-filed tax returns will allow you to keep your best gains and not be hassled by IRS. An audit can quickly become a time sink.

It is a common practice to use specialists wherever possible. Incfile is a small company, which is very focused on business formations. They almost certainly outsource their bookkeeping and tax offerings to a third party.

A certified small business accountant who is experienced in bookkeeping, account management, and taxation is your best option.

Dissolution: $149

Dissolution refers to the dissolution of a business. The first step in closing down your LLC’s operations is to file Articles of Dissolution with the state. These articles let the state know that your LLC is no longer in business.

Your company may be in “Good Standing” if it has outstanding taxes or fails to file annual reports. This could prevent your company from being dissolution. Before you file your Articles of Dissolution, make sure that these issues are resolved.

These forms must be filed with the IRS.

Conclusion

We recommend Incfile. They have been in business for almost two decades. Their biggest draw is their low prices on many services. The Silver package LLC formation is free and offers bare-bones services at an unbeatable price. Their registered agent service is also free for a full year.

Incfile’s Gold Package provides everything you need for your business at a low price of $149. This is best-in-class pricing.

Incfile also offers a number of other one-off services that are related to formation. Incfile also offers a user-friendly website and an extremely helpful online dashboard.

Incfile’s customer reviews, and customer service offerings, raise red flags.

Trustpilot and Yelp have average to poor ratings. Many reviewers complain about delays, application errors, and difficult-to-reach customer support.

Incfile has a section in their customer review that outlines the improvements they have made to their customer support services. These statements can be taken at face value if you’re willing to overlook their less than stellar review history.

Incfile offers many other services in addition to its main offerings. However, such services like accounting and bookkeeping are best left to professionals.

Incfile may be a good choice for you if you’re looking for an easy way to create LLCs or for a related service (e.g. DBA registration, Foreign Qualification Filing, Annual Report Filing).

Customers should check out the track record of the company before they commit. While a cheaper service may seem appealing, the hassles associated with a delayed or incorrect filing could quickly outweigh any price points savings.

Incfile – If you want fast and affordable LLC formation along with the option of tax return services, Incfile is the one.

LegalZoom – If you want a business with strong brand recognition and additional legal services like wills, trademarks, the option of talking to an attorney, and monthly legal services, LegalZoom is the one.

So basically, you can approach Incfile to help form a company, related services, and business taxation. Incfile is the right choice if the nature of your business does not often expect legal issues. The better option for businesses that regularly need legal help would be to go to LegalZoom or shift later to LegalZoom after starting with Incfile.

Frequently Asked Questions

Are Online Legal Services Law Firms?

The answer is no. Online legal services are not law firms. However, they can provide access to legal documents, lawyers, and law firms. Legal advice is only available through the lawyers they connect you to, though it is not attributed to the online legal service. They cannot directly provide legal advice but are handy when filing and submitting legal paperwork.

Can Incfile help me acquire a business license/permit?

The answer is no. Incfile can assist in forming the company as either an LLC, a corporation, or a non-profit organization. Acquiring a business permit is entirely separate, but for $99, Incfile offers the Business License Research Package to obtain a business license through a partnership with License Logix.

Do I need an attorney to form an LLC?

The forming of a Limited Liability Company does not require lawyers, though individual partners can have lawyers present during meetings to protect their respective interests.

Will I get my EIN Tax ID the next day?

We can perform the filing immediately. However, the release of the EIN will be up to the state itself, and you will be notified once done. The same thing goes with company registration. It is dependent on filing times per state.

I already have an EIN; can I use that?

You may use your current EIN with your order. In the case of Incfile, customers will need to fill in the social security number field with zeroes to prevent Incfile from automatically filing for an EIN. Customers need to notify Incfile to include the current EIN for services that require it. Having an existing EIN, however, does not affect the prices of any package.

Can other LLCs be part of an LLC?

Yes. Many states allow for other LLCs, corporations, and companies to be members of an LLC.

Can Non-US residents be part of my business?

In many states, yes. Many states designate that an LLC can be owned by anyone, including a non-US resident, as long as they operate using US tax codes to be taxed accordingly. Incfile can help with this by becoming the company’s Registered Agent.

I want to form an LLC, but I am the sole owner of the business.

Yes. LLCs can be formed by a single individual, thanks to revised IRS regulations permitting single-member LLCs.

Does Incfile offer any discounts or promos?

No. Incfile is already at a highly competitive price point, and it cannot afford to lower its revenue through discount promotions.

What do I need to do for my business to remain compliant?

Compliance requirements depend from state to state, but most states require submitting the Annual Report on the company anniversary. The annual report contains information on the company’s members and an updated business address.

Other requirements include submitting updated company by-laws, proof of yearly director or shareholder meetings, and updated operating agreements for LLCs. Incfile will email you reminders when the report and other requirement submissions are due.